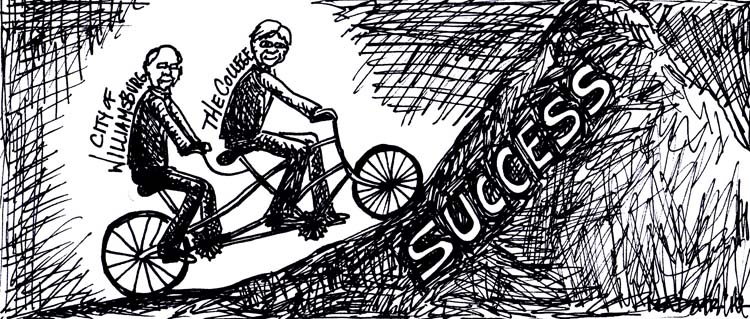

For the first time in 21 years, the City of Williamsburg is raising the real estate tax. This year, the tax will increase from $0.54 to $0.57 per $100 of assessed value. While no one appreciates a tax increase, the real estate tax in Williamsburg remains significantly lower than those in the surrounding areas. City residents have revenue from tourism taxes to thank for this disparity. It’s no secret that the College of William and Mary brings in a huge amount of tourism revenue for the city. Hopefully, this increase will remind residents of the benefits of having college students in the city and encourage both the city and the College to make more of this relationship.

From football games to graduation, the College constantly brings money into the city. Revenue from tourism tax pours into the city when alumni make hotel reservations, when students make late-night Wawa runs and when parents take their children to a restaurant. From an economic standpoint, the College is an asset to the city. As the state continues to pressure the school to expand, the amount of tourism revenue will only increase. In order for the expansion of the College to be successful, however, city residents must be willing to work with students to provide better off-campus housing to cover the needs of the growing school.

In turn, students at the College must be willing to increase efforts to bring money into the city. We are pleased that this year’s Charter Day was such a success, but we want to see more. If the College takes part in hosting larger-scale events, like arts shows that appeal to a wide population, the school can help attract more tourism in addition to serving as an entertainment opportunity for residents. By upgrading events like homecoming, the College will encourage more alumni to visit their alma mater and to spend more money in Williamsburg. Not only will the College be improving town-gown relations, but the student body will be able to take advantage of more big-name events.

If the College and city collaborate to pool resources, both groups will profit. A large portion of the money raised in taxes will go toward capital projects, such as apartments and sidewalk construction. These projects will make living off campus more comfortable for students who will not have to search as far for apartments, as well as help group students living off campus together. While students may not be able to do anything about some of the more oppressive restrictions imposed by the city, an increase in apartment complexes means that the three-person rule will be less of an inconvenience and residents will be less likely to notice and report noise violations.

City residents do not want to have to pay more money in real estate taxes. However, the fact remains that state revenue is decreasing; at the College, we are well aware of what state budget cuts mean. Funding has to be recovered somewhere, so rather than bemoaning the tax increase, we can hopefully look forward to a better Williamsburg for both residents and students.

Editor’s Note: Katherine Chiglinsky recused herself from the meeting to remain objective in her reporting.