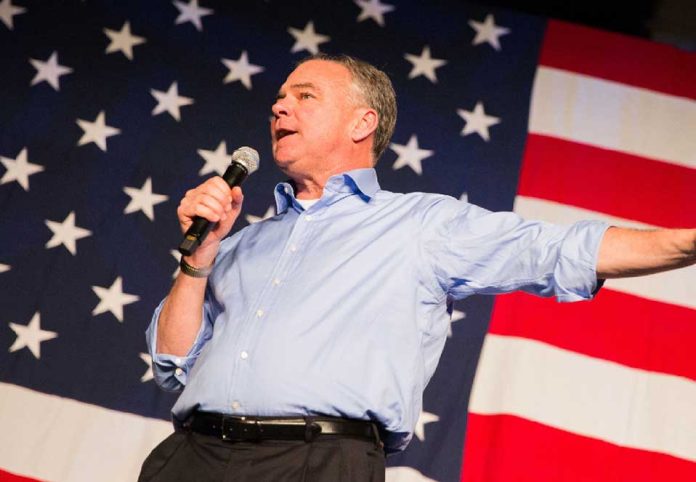

Thursday, June 20, various U.S. senators, including Virginia’s Tim Kaine LL.D. ’06, introduced the Pell Grant Preservation and Expansion Act of 2024. The legislation seeks to double the maximum award and preserve the grant’s value against inflation.

The act aims to expand the Pell Grant program’s effectiveness and outreach to recipients. Currently, over 6 million undergraduate students rely on the Pell Grant program for the opportunity to pursue higher education.

The proposed bill highlights necessary changes within this federal program, such as extending recipients’ eligibility from 12 semesters to 18, which will allow more students to attend graduate schools and other forms of continued higher education without the weight of financial insecurity.

It also proposes amendments to increase the eligibility of undocumented students.

“Every year, millions of students rely on Pell Grants to afford higher education,” Kaine said in a press release. “I’m proud to introduce this bill to increase the Pell Grant award, boost funding for the program, and allow more students to access this crucial support. I urge my colleagues to pass this bill to help future generations get the education and training they need to pursue their dreams.”

Suzanne Clavet, the College of William and Mary’s director of Media Relations, said the College does not comment on pending legislation.

Associate Provost for Enrollment and Dean of Admission Tim Wolfe outlined the College’s policy regarding Pell Grant admissions via email with The Flat Hat.

“Last fall, the Class of 2027 included 14% more Pell Grant-eligible students than the year prior,” Wolfe wrote. “Though our enrollment is not yet final for this fall, we expect close to 20% of our incoming first-year, in-state students to be Pell Grant-eligible. In addition, the university remains committed to supporting our students with financial need and aims to meet 100% of demonstrated need for all in-state students.”

Other U.S. senators expressed their support for the bill, including Maryland’s Ben Cardin.

“The only prerequisite for secondary education opportunities should be a passion for learning,” Cardin said. “The Pell Grant program is a proven pathway for more diversity on college campuses and ensures that higher education is not reserved for those with generational wealth.”

Rhode Island Sen. Jack Reed weighed in about the effects of inflation on the award, outlining the prospective success of these amendments.

“The Pell Grant is the cornerstone of our federal financial aid programs,” Reed said. “But over the years, the grant has covered a shrinking percentage of the actual cost of college, requiring students to take on more debt or, even worse, not continue their education. This legislation would help expand access to Pell grants, lower student debt, strengthen our workforce and economy, and help deserving students achieve their full potential.”

Congressman Mark Pocan (D-WI2) commented on the semester extension to the bill and its effects on recipients’ opportunities, as well as the amendment to support undocumented citizens.

“Unfortunately, skyrocketing tuition costs and perpetual underfunding continue to undermine this critical program,” Pocan said. “The Pell Grant Preservation and Expansion Act would not only double the maximum Pell Grant, it would protect the program from future cuts, expand eligibility to include Dreamers, and ensure that postsecondary education is attainable for every student — regardless of their socioeconomic status.”

A Pell Grant recipient at the College offered an anonymous comment to The Flat Hat on the pending legislation.

“William and Mary’s financial commitment goes far and beyond what’s advertised, they made it well within my family’s scope to attend my dream school without any financial stress or barriers,” the student said. “Seeing the program be expanded makes me so excited to see how many more students will be able to attend this wonderful college without experiencing financial stress or insecurity.”