City pockets soon may feel the effects of local tax increases for the first time in two decades.

Williamsburg City Manager Jack Tuttle proposed raising taxes to compensate for increased expenditures in the Fiscal Year 2013 budget released March 16.

Tuttle proposed a $32.2 million budget, an increase of $200,000 from the Fiscal Year 2012 budget. In years past, the budget has included a surplus of almost $3 million, but in 2008, the surplus decreased significantly.

“With the recession, our revenues dropped dramatically, and now we’re down to a $300,000 surplus,” Tuttle said. “We’ve had to cut expenditures dramatically.”

To compensate for the decrease in revenues, Tuttle has recommended an increase of the real estate tax from $0.54 to $0.57, the cigarette tax from $0.25 to $0.30 and the personal property tax from $3.50 to $4. The city generally receives 39 percent of its revenue from property taxes.

According to Tuttle, estimated revenue would fall to $31.3 million if no property and cigarette tax increases are approved, leaving a budget gap of about $1 million.

Williamsburg generally receives around 44 percent of its revenue from local taxes, including room and meal taxes garnered from the strong tourism base. No cuts were made to tourism funding, and Tuttle estimated a 4.2 percent increase in meal tax collections for Fiscal Year 2013.

Planning Commission member Chris Connolly ’15 supported the city manager’s decision to raise taxes.

“I think the real estate tax raises are pretty slight, so I don’t think it’ll have a profound impact [on development in the city],” Connolly said. “With a $1.6 million shortfall, you’re going to have to make some increases in revenues. This increase makes sense.”

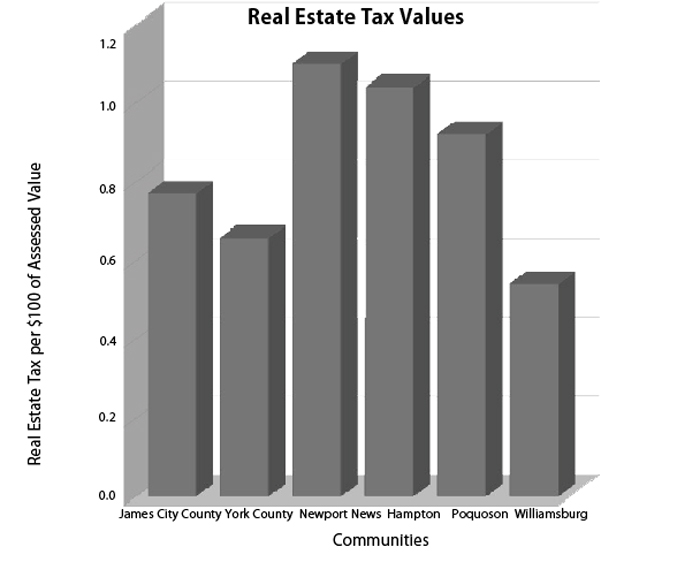

Even with the raise in the real estate tax, Williamsburg maintains the lowest tax rate of the surrounding localities with York County at a rate of $0.6575 and James City County at a rate of $0.77.

“We also have terrific services,” Mayor Clyde Haulman said. “People in the city don’t pay a separate tax for garbage collection or streetlights. Plus, you pay a significantly lower tax rate.”

The proposal of tax increases comes in a year when three members of the council are up for re-election. Tuttle, however, noted that members need to consider fully the additional costs in schools, the additional costs of the Virginia Retirement system, the rising costs of healthcare for employees and the estimated 2.3 percent decrease in state revenue for Fiscal Year 2013.

“No member of city council said we should take these options off the table,” Tuttle said.

Tuttle also proposed decreasing the amount of full-time-equivalent city employees from 183 to 182.5, which would create a permanent part-time position and remove one full-time position.

The number of full-time employees in the city has decreased significantly over the past five years, but Haulman noted that the city can no longer afford to make staffing cuts.

“From 2008, we’ve decreased from 202 employees to 183,” Haulman said. “I don’t think we can cut any further and maintain the quality of services. I think with the number of people and the operational budget cuts in departments, we have people doing more with less. I think we’re really pretty close to that line. There’s no fat in this budget.”

Due to the delay in the state budget, the proposed budget may need to be revised before the council adopts the final version at the May 10 meeting. The General Assembly’s Senate Finance Committee passed an $85 billion budget after a long budget standoff Thursday. The proposal will be presented to the full senate Monday before moving to a vote in the House of Delegates.

According to Haulman, the decrease in state funding is a continuation of a greater trend in government budgets.

“It’s been a long-term trend, and it’s a result of the fact that the state won’t change its taxes or change its revenues,” Haulman said. “At some point, somebody’s got to pay and it’s falling at the local level.”

The council met for two budget work sessions this past week. A formal budget hearing will be held April 12, while the budget is scheduled to be adopted May 10.