In a struggling economy, one thing is clear: Education does not come cheap. Tuition costs at the College of William and Mary seem to be in a never-ending upward spiral. Pair that with the increased difficulty in finding jobs and growing demand for masters degrees, and it should come as no surprise that student debt is rapidly rising. President Barack Obama’s proposed plan to help students shoulder this debt involves loan forgiveness after 25 years. Affordable education is necessary for closing the opportunity gap; however, the plan’s flat-line basis for loan forgiveness does not help low and middle-income students, and it is laden with negative consequences for the federal government’s budget.

Obama’s plan assigns loan forgiveness based on how much debt students have acquired, so a high-income student with higher debt from graduate school could receive more forgiveness than a low-to middle income student. Loan forgiveness that is assigned on a bottom-line basis is inherently unfair and would mean that the problem of soaring student debt would only be solved for some. Professional schools like medical school and law school are expensive, but students in these schools tend to make more money after graduation than someone attending a graduate school for anthropology or classical studies.

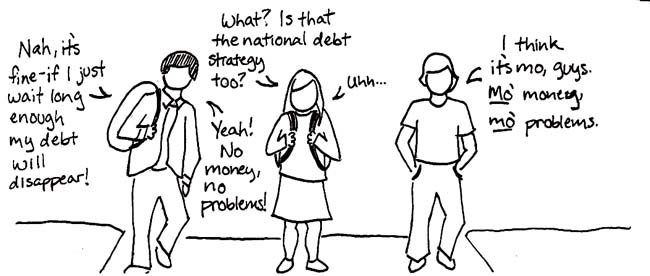

Furthermore, because this plan promises loan forgiveness, it removes any incentive on the part of colleges to strive for a low cost of tuition. With this plan, colleges could argue that students will not be affected by rising tuition rates and therefore justify increasing the price tag. Ultimately, this act will hurt students who must pay back their loans for the first 25 years. Such large debt will force students to make the maximum payment possible for that time. After the 25 years, the debt will be passed off to the federal government. If students are no longer able to pay the price of tuition, then the federal government will be left shouldering this massive debt — and if the current federal deficit is any indicator, the U.S. government cannot afford to take on this cost.

At the College, Obama’s plan has very real consequences for the tuition cost that students pay. Since it is a public school, the College’s tuition is determined primarily by the commonwealth of Virginia. If the state government decides that because of the debt forgiveness program, a rise in tuition will not hurt students, the state could dramatically cut the amount of funding it gives to the College and let the price of tuition skyrocket. Ultimately, the federal government would be left cleaning up the mess of unpaid debts resulting from a situation they have helped create.

Student debt will not be solved by loan forgiveness; rather, this problem needs to be addressed before students graduate. The only practical solution is to strive for lower tuition costs, which will lessen the burden of debt for everyone. At the College, this means doing everything possible to get more funding from the state and to make the most efficient use of the funding that the school receives.