With the presidential campaigns down to the wire, the presidential candidates have turned to college students to garner votes and rising college tuition remains an important issue.

According to The Associated Press, in the past four years, the average public four-year college has increased its tuition 26 percent.

Associate professor of American politics Paul Manna at the College of William and Mary believes that it “is hard to say,” which candidate would help students more with tuition.

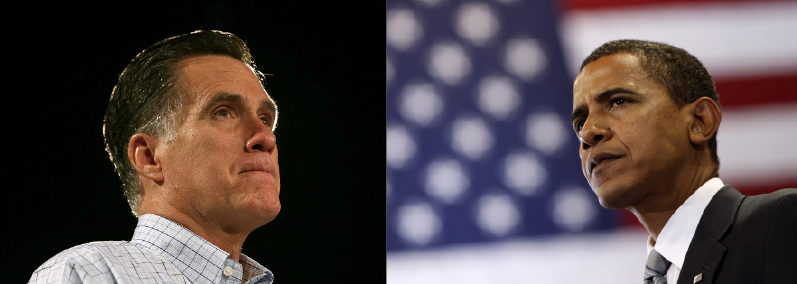

“You would be more reassured with [President Barack] Obama given that he’s actually laid down a marker,” Manna said. “He has been explicit on that. With [Mitt] Romney, it’s more unclear. If you’re really making your judgment based on what information the candidates have given to you, Obama is more specific.”

According to the AP, Obama has proposed a $1 billion contest called “Race to the Top,” which would reward states for tuition reforms and cut off federal grant money to states which did not increase productivity. He wants to cut tuition inflation in half within 10 years.

Romney’s campaign, too, has stated that federal government needs to stop funding states that are not making an effort to cut college tuition. As governor of Massachusetts, Romney created the John and Abigail Adams Scholarship. The scholarship provides top students free tuition at any state college, but it does not cover some mandatory fees; these fees are sometimes higher than the cost of tuition.

“Romney believes that there is no reason we should be sending out blank checks to students and not ensuring that they are being used as efficiently as possible,” Daniel Ackerman ’16, a member of the College Republicans, said.

Obama has also stated his plans for grants and loans. Washington will spend $50 million more this year on federal aid for students than it did in 2008. Spending on Pell Grants has increased to $35 billion, supporting an additional four million students.

Obama has changed the student loan system so that most loans come directly from the government instead of private banks. His current plan states that loans cannot exceed 15 percent of income and will be forgiven after 25 years. The proposed plan states that loans cannot exceed 10 percent of income and will be forgiven after 20 years. The AP also reports that he wants to perpetuate the American Opportunity Tax Credit, which provides a tax refund of up to $2,500 to 10 million families who have children in college.

“Decreasing the time for student loan forgiveness is really important,” Vice President of Young Democrats Michaela Pickus ’14 said. “[Obama] just finished paying back his student loans a few years ago and he had to write a best-selling book to do it, so he understands. That’s different from Romney who said that people should try to borrow money from their parents. That’s not an option for everyone.”

While Manna commends Obama for having clear plans, he still wonders whether he will be able to achieve his goals.

“The question remains … Can he get more money to students and can he make it more economically feasible for students to attend college?” Manna said.

This is why Ackerman believes that Romney’s plans are more financially sound.

Romney would use the HOPE tax credit, which is less expensive. Under that system, a student could receive up to $1,800. He wants to continue developing the Pell Grant foundation, but believes that the program should focus on the neediest students. Governor believes the direct lending program is too much of a financial burden on the government.

“Neither candidate supports massive spending cuts to the education system; it’s more that Romney wants a reorganization of the way that grants and bonds are given out,” Ackerman said.